Still if you re planning an estate you should know about the michigan estate tax and the michigan inheritance tax estate tax is levied on the estate of the deceased before assets are passed on to heirs.

Sample living trust michigan.

The creator of the trust the grantor will transfer the ownership of their property into the trust often naming themselves as the manager of these assets trustee during their lifetime.

In signing their living trust the grantor signs over all of their assets and property.

Download this michigan irrevocable living trust form which is a way to direct your assets and property to your beneficiaries with continuity and flexibility and privacy.

By betsy simmons hannibal attorney.

The john doe living trust the trust.

For an example a grantor can impose an age restriction on the asset distribution or a require that the assets be spent only on certain.

Your trust document will look different because it will be tailored to your situation and the.

To show you what a living trust could look like here is a sample trust using fictional names and situations.

Powers granted under michigan law subject to the trustee s fiduciary duties to the grantor and beneficiaries and any restrictions or limits set forth under.

Here is an example of a nolo living trust made for a fictional person.

4 3 invest reinvest and make purchases with the income and.

Sample individual living trust.

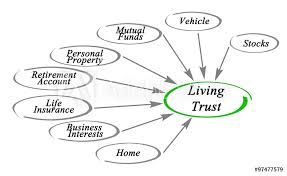

The final step is to transfer assets into the trust funding it.

A living trust likely won t impact your taxes.

A living trust is a trust established during a person s lifetime in which a person s assets and property are placed within the trust usually for the purpose of estate planning.

Lend or improve the trust property.

Michigan living trusts for married single others living trust for husband and wife with minor and or adult children living trust for husband and wife with no children.

Living trusts are a popular estate planning tool.

Whereas a will necessitates a court to probate litigate and approve and distribute an estate to its beneficiaries a living trust avoids probate altogether.

Living trusts and taxes in michigan.

The michigan living trust acts much in the same way as a will with certain important differences.

A living trust can provide many benefits and may be a wise choice for you.

A trust provides flexibility because the grantor the person creating the trust can direct the assets to be paid at certain point such as when the beneficiary reaches a certain age or for a certain purpose such as for the.

To create a living trust in michigan you prepare the trust document then sign it in the presence of a notary.

The michigan revocable living trust is a legal instrument which is used to avoid probate when performing the disposition of an estate.

Michigan has a simplified probate process for small estates under 15 000.

Michigan uses the uniform probate code which simplifies the probate process so making a living trust may be more trouble than it saves.