As of march 30 2020 the fund has over 5 of its holdings invested in health care reits.

Senior living reit etf.

A reit etf is a type of fund made up exclusively of reit stocks.

The 10 best reits to buy for 2020 real estate offers diversification and far more income than the market average.

It has a low expense ratio of 0 12 so investors don t have to worry about the expense chipping away at.

Like all reits these firms are not subject to federal income tax so long as they distribute 90 of their taxable income to shareholders.

A health care real estate investment trust known as reit could be a smart move if you want to capitalize on aging trends by including senior housing medical and nursing facilities in their.

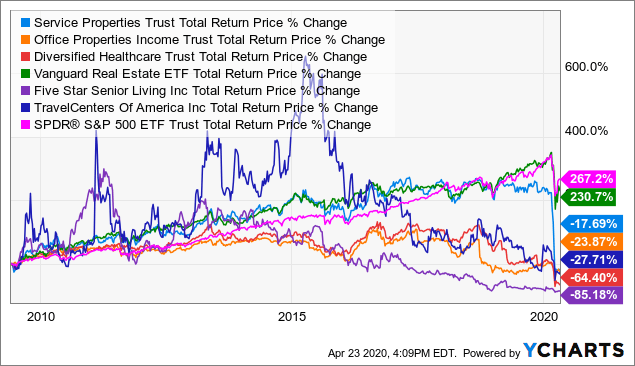

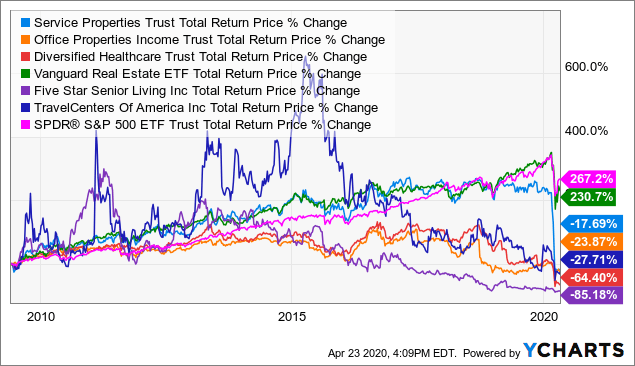

Senior housing property trust s credit ratings of bbb baa3 while still investment grade are lower than those of the other reits discussed.

The portfolio is 71 skilled nursing facilities 19 assisted independent living senior housing and only 10 non senior focused properties.

These are the 10 best reits you can buy as 2020 comes into focus.

Beyond the questions above you should.

This vanguard reit etf is a great income producing investment with a yield of 4 1.

Senior living reits are largely in the healthcare reit sector.

If you want to invest in real estate but can t afford to invest in properties directly or build a diverse portfolio of reits a reit etf may be the right starting point for you.

The ishares cohen steers reit etf icf is another of ishares etfs that has exposure to the reit sector.

In other words senior housing property trust has a.

Healthcare reits own and operate properties including hospitals senior housing facilities skilled nursing facilities and other medical office buildings.

Senior housing properties trust snh one of the biggest players in the senior housing segment with 372 properties spread across 38.